In September 2025 the Food and Land Use Coalition published Re-WIRE Agri-Food Value Chains. The report presents a framework to map risks and opportunities across major commodity value chains (e.g. beef, soy, cocoa), showing how climate, regulatory, financial, and human rights pressures are reshaping agrifood systems, and offering pathways for more resilient, regenerative supply chains.

The report characterises “value chains are the arteries of food systems”.

Over the past 50 years, they have funneled innovation and finance to deliver historic gains in productivity, food security, and economic growth. Yet most value chains face major physical risks, generate unsustainable social and environmental impacts, and are vulnerable to long-term declines in productivity. Climate change threatens to slash global crop yields by up to 35% by 2050. And the same value chains that once created abundance now contribute to nature loss, climate breakdown, poverty, and poor health. As a result, food and agriculture businesses face a mounting array of reputational,legal, and business continuity risks. (Empasis added).

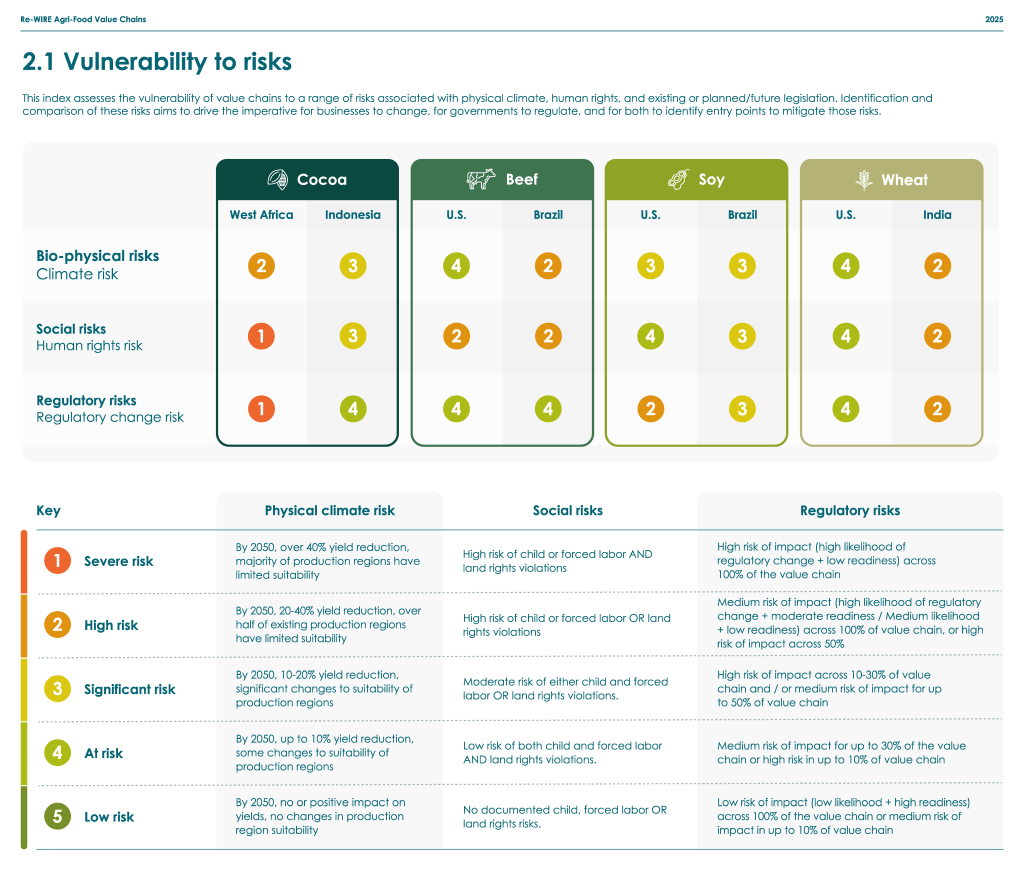

The report identifies risks, impacts and opportunities associated with the four crops. The chart below identifies vulnerability to risk.

Beef

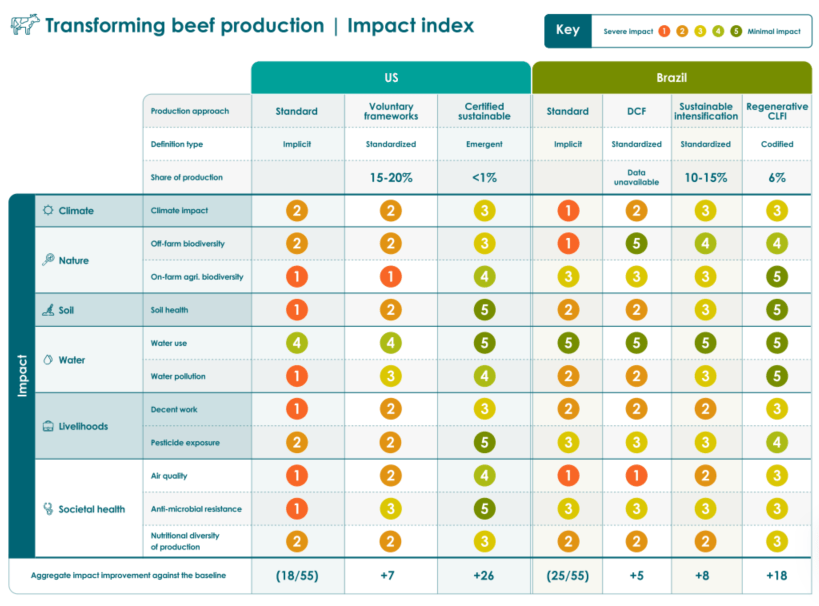

We don’t grow cocoa and soy commercially and we import a lot of wheat, but beef remains an important product here. The report includes an in-depth study of beef production in Brazil and the U.S. This table, from page 49 of the report, identifies the severity of the impact of production in each country on climate, nature, soil, water, livelihoods and societal health. 1 (orange-red) denotes a severe impact, and 5 (green) denotes a minimal impact. Note that changing the production method can mitigate impact significantly across all impacts in both countries.

The U.S. has concentrated animal feeding operations (CAFOs). It accounts for 33% of global soy production, but also imports 19% of the global total, contributing to environmental and climate degradation. Beef production in Brazil is a cause of deforestation.

Regenerative beef

The top four rows of the table above reveal the types of production in both countries. In the U.S. about 80% of the production is standard (orthodox). 15 to 20% is produced with voluntary frameworks, probably including the growing regenerative beef production systems. Certified sustainable is less than 1%.

In Brazil, roughly 80% is standard or DCF production. Sustainable intensification production accounts for 10 to 15% of production and Regenerative CLFi production for 6%.

What about Aotearoa?

It is hard to find the extent of organic or regenerative beef production in Aotearoa. But our production systems are a lot less impactful than those of the U.S. or Brazil. Almost all beef in Aotearoa is raised on pasture. And it tends to use less fertiliser than dairy. There still are environmental impacts caused by erosion. Methane is probably not an issue for pasture-raised beef as the hydroxl ion that oxidises methane is produced from water vapour the presence of ultra-violet light and is here in abundance.

So while our beef production has a more benign impact than U.S. or Brazillian beef, the report provides and excellent framework for shifting to better practices, probably best manifest in Aotearoa as regenerative practices. On Page 54 the report outlines the commercially viable options for accelerating the shift to lower risk, lower impact production.

Establish legal compliance as the market baseline by investing in traceability, embedding traceability into contracts and finance.

Make finance conditional on legal, DCF supply and redirect finance and technical assistance to small and mid-sized producers, using blended finance to de-risk the transition to more sustainable, regenerative beef production, and scale regenerative practices.

Build a shared vision for more regenerative, resilient beef, framing the transition around rural development,resilience, and national pride to secure buy-in from producers, buyers, consumers, and governments.

Other stakeholders to support the transition are meat processors, restaurants, retailers, and banks.

These are written for the U.S. and Brazil, but could easily be translated into a transition plan here. A Cascade of benefits would follow the full-scale transition to regenerative beef – better human and animal health, improved soil structure leading to many climate and environmental impacts, including drought and flood resilience, improved biodiversity, and food security.

This is interesting however is there a definition of “regenerative Practises” without an understanding of that it is pretty meaningless to me.

LikeLike